Home ownership. Such a core aspect of living the American dream. However, during the 2008 financial crisis the American dream very much became the American nightmare. At that time housing became very overvalued. When people began defaulting on loans, the system harshly corrected itself. This left a sea of destroyed finances with people either bankrupt or so upside down on their mortgages that the likelihood of building equity became practically zero.

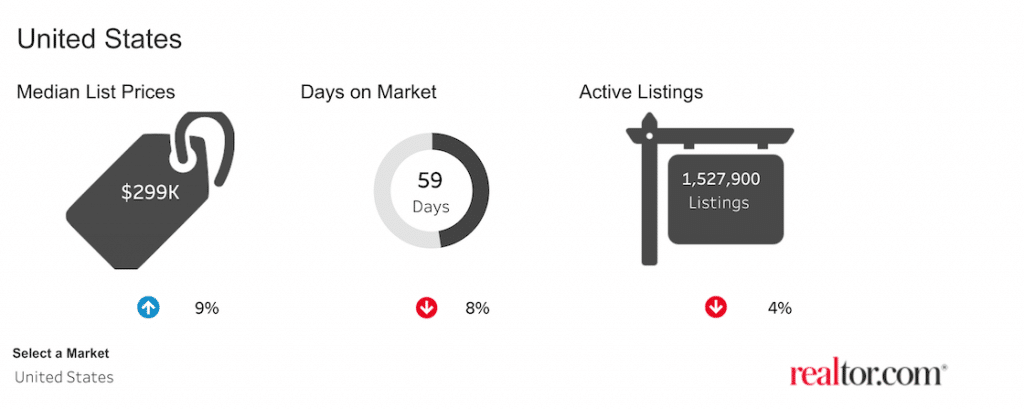

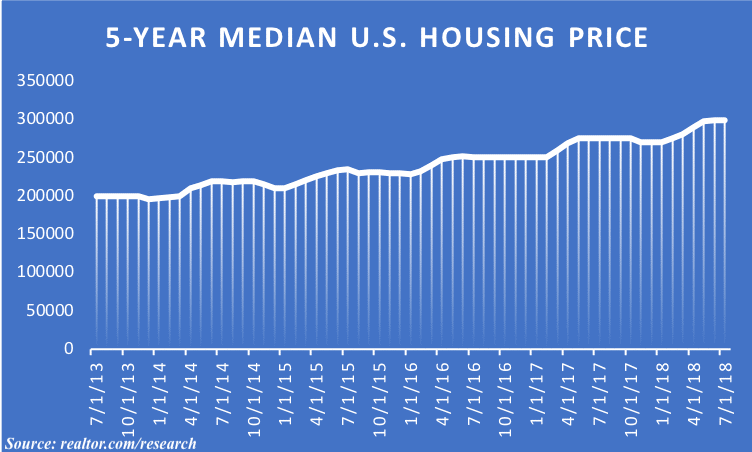

The economy has largely recovered, but as the philosopher and essayist George Santayana stated over a century ago: “Those who cannot remember the past are condemned to repeat it.”The price of housing and the rate of sales are ramping up. The most recent housing data from realtor.com shows the median home price across the United States is $299,000. This reflects a $99,050 rise in median home price compared to just 5 years ago.

Source: https://realtor.com/research

An interesting tidbit is that the $29,500 of the $99,050 rise has occurred since the beginning of 2018. This means that not only is the median price going up, but more importantly, the rate of rise is increasing as well. I definitely see these stats to be true in my area. Both the number of houses being built and the typical asking price have risen sharply in the past 8 months. Home ownership is on the rise.

Numbers aside, I don’t believe we’re due for a correction that mirrors what happened in 2008. Much of what happened during the financial crisis was due to banks and investment houses committing fraud with how they securitized mortgages. The stats do highlight that anyone currently in the market for a home should be aware that they will be paying substantially higher prices. A house is the largest purchase most people will make. As such, it has the greatest ability to impact your long-term finances. With that fact established, what factors should a potential home owner evaluate as part of their buying process?

Acquisition Costs

A new home owner should aim to save at least 20% of the purchase price as a down payment. This will allow them to avoid paying PMI (Private Mortgage Insurance). PMI is insurance your lender will force you to pay until you have a 20% or higher equity position in the home. They do this to protect themselves. Your lender figures that you’re much less likely to walk away from a loan when you have skin in the game.

To illustrate what PMI will cost you, consider the following example.

- Mortgage: $300,000

- Term: 30 Years

- Interest Rate: 4.59% (current average)

- Down Payment: $12,000 (4% of loan value)

If we run these numbers through a PMI calculator, we get an estimated PMI cost of $132.00 / month or almost $1,600 per year. This is in addition to the $1607.00 you’ll pay per month towards the mortgage. Together, the mortgage and PMI will cost you $1,739 per month or almost $21,000 annually.

The loan amortization schedule will have you paying PMI for at least the first 116 months of the loan for a total cost of $15,312. Ouch. Bottom line, it’s worth it to save up 20% of the purchase price before buying.

Additional Home Ownership Considerations

There are additional home ownership considerations that can have a pretty big impact on your finances. The common carry costs include items like:

- Insurance

- Maintenance

- Homeowner Association Fees

- Taxes

- Neighborhood Influence

Let’s dig into each of them.

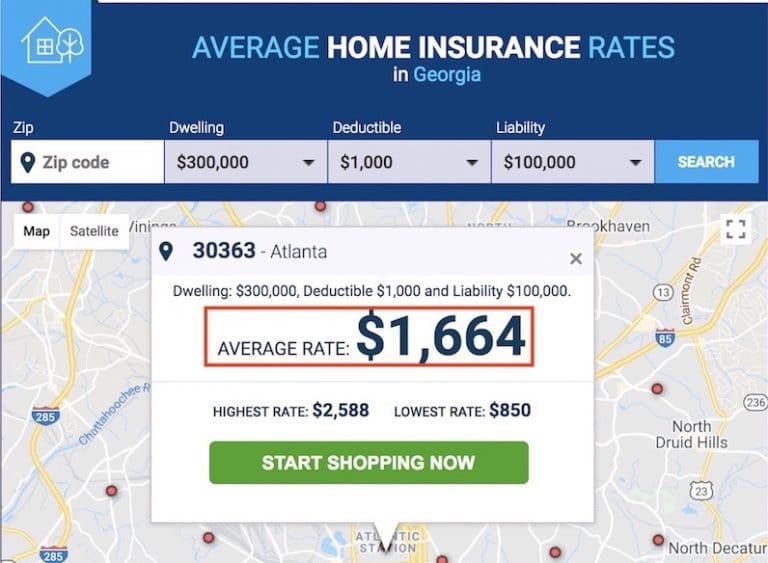

Insurance

Home insurance pricing varies broadly depending on where in the country you live. The average insurance price nationwide is $1,083. The home insurance quote I obtained for the Atlanta area shows an average rate of $1,664 per year. This is based on a $300,000 home with standard insurance options. I’d expect this number to be higher in the northeast U.S and California where the cost of living is much higher. Also expect to pay more in Florida and other coastal areas due to increased chances for storm damage and flooding.

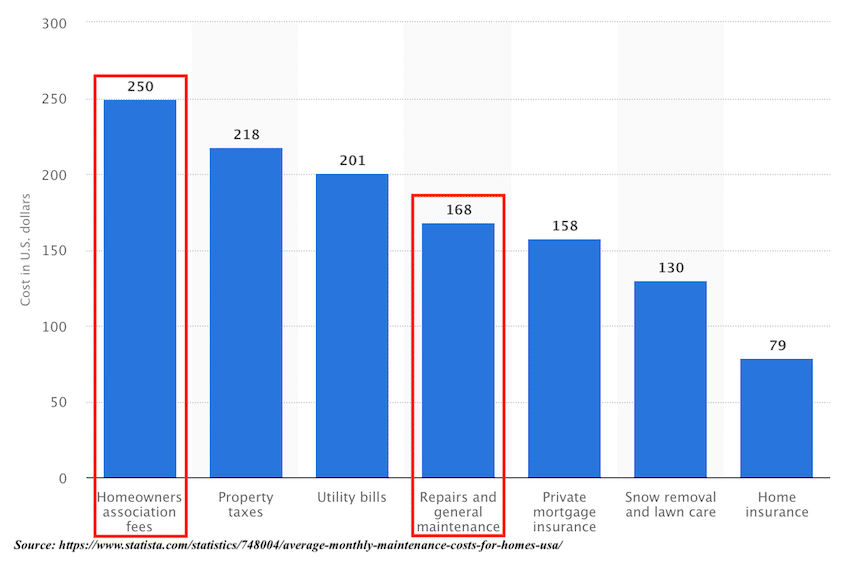

Maintenance

The more expensive the home, the more it costs to maintain. Air conditioning units and furnaces for these homes are more expensive so when they break expect those costs to be higher as well. In my area, lawn care is very much a thing, so those costs need to be factored in as well. The best number I was able to find for monthly maintenance set the cost at $168 per month. This is a national average so depending on your area, you’ll have to modify this number to suit.

Homeowner Association Fees

If you live in a community that provides amenities such as pools, tennis courts, or a gym, expect to pay higher home association fees. These fees can vary depending if things like lawn care are also included. Having lived in both condos and standalone homes, I’ve found that condo HOA fees tend to be more expensive. The national average for homeowner association fees is $250.00 per month. Again, depending on your situation, this number will vary.

Taxes

You didn’t seriously think we could discuss the cost of home and not bring up taxes, right? While doing the research for this post, I came across an article that cited the average for national property taxes at 1.19% of home value. This means our $300,000 home will cost approximately $3,570 per year in taxes. A state like New Jersey has much higher property taxes. Expect to pay 2.19% of property value or $6,570 per year; almost double. The lesson here is the area of the country where you choose to live has a huge impact on amount of taxes you pay for the privilege of keeping your home.

Neighborhood Influence

Neighborhood influence might be better stated as the “Keeping up with the Joneses” effect. In a nutshell, where you live influences your spending habits outside of areas directly related to home ownership.

If you live in a golfing or a tennis community expect your neighbors to own golf carts and the associated accoutrements. If your neighbors drive nice cars, it’s likely you’ll be pressured to do the same. This also applies to things like home furnishings, exterior enhancements like patios or pools, and lawn care. When your neighbors host parties, you’ll probably feel a sense of obligation to do the same at some point.

Neighborhood influence is a silent but very large expense associated with home ownership. It’s normal to want to fit in and march to same relative beat as your peers. In the area of home ownership, this need to keep up with the Joneses can be very damaging to your finances over a period of time. The recurring expenses associated with living in your particular neighborhood can be one of the greatest advantages or detriments to building your net worth.

Rules You Can Use

While owning a home can be a wonderful thing, you need to count all the costs involved. The monthly mortgage payment is just the tip of the iceberg. The costs of insurance, HOA, maintenance, and taxes can easily exceed your mortgage. If we also factor in the hidden costs of neighborhood influence, things can get out of hand pretty quickly. I wanted to leave you with 3 guidelines that should keep you out of trouble as you plan for your slice of Americana.

Make a 20% Down Payment to Avoid PMI

PMI is essentially an additional tax that is completely avoidable. It doesn’t make sense to spend thousands of dollars per year with nothing to show for it. It’s much better to save and make a 20% down payment when buying. It shows the lender you’re serious and avoids PMI and secondary mortgages. It also makes it easier to pay off the loan faster since you’re not starting with a 100% debt position.

Keep Your Mortgage to 30% or Less of Your Take-Home Pay

Make it your goal to allocate a smaller percentage of your income to your mortgage. This is in line with my post on creating financial margin in your life and helps to reduce stress. For most people, their mortgage will be around for many years so it makes sense to leave room for other things in life.

You’ll no doubt want the ability take vacations, furnish your home and help others. Most importantly, you need to have money available for investing. Living the live you want now while building for the future takes free cash flow. Don’t structure your finances where you end up house poor.

Don’t Buy at the Top of Your Neighborhood

Let’s say your budget and finances allow you to buy a $300,000 home. Your goal should be to buy the home in a neighborhood where $300,000 represents the median price. Don’t buy a $300,000 home in a $150,000 community because when the time comes to sell, you’ll have more trouble doing so. People that are in the market for a $300k home, typically want it in a community of other 300k or more homes. Following this advice also leaves more room for your home to appreciate since it doesn’t represent the top of the neighborhood.

Home ownership is a great goal and also tons of fun when done the right way. I hope you found this information useful. What do you think about the idea of limiting your mortgage costs to 30% or less of your take-home pay? Let me know in the comments below!